If you want to save money, the best way to find cheaper car insurance rates in Miami is to compare quotes once a year from companies that insure vehicles in Florida.

If you want to save money, the best way to find cheaper car insurance rates in Miami is to compare quotes once a year from companies that insure vehicles in Florida.

Step 1: Read about the coverage provided by your policy and the changes you can make to prevent expensive coverage. Many factors that cause high rates like inattentive driving and an imperfect credit rating can be amended by making lifestyle changes or driving safer. Later in this article we will cover tips to keep prices down and get discounts that may be available to you.

Step 2: Compare prices from direct carriers, independent agents, and exclusive agents. Direct companies and exclusive agencies can give quotes from one company like Progressive or Allstate, while independent agencies can provide price quotes from multiple sources.

Step 3: Compare the quotes to your existing coverage to determine if switching companies saves money. If you can save money, make sure coverage is continuous and does not lapse.

A good tip to remember is that you’ll want to compare the same physical damage deductibles and liability limits on every quote and and to get price estimates from as many companies as feasibly possible. Doing this ensures a level playing field and many rates to choose from.

It’s well known that car insurance companies don’t want you to look at other companies. Consumers who shop around for cheaper prices are very likely to switch to a new company because they stand a good chance of getting low-cost coverage. A survey found that drivers who did price comparisons regularly saved on average $865 annually compared to other drivers who don’t make a habit of comparing rates.

If finding discount rates on insurance is your objective, then having an understanding of how to shop and compare auto insurance can make it simple to find affordable coverage.

Quoting and buying affordable auto insurance coverage in Miami is not as time-consuming as you think. If you are insured now or need a new policy, take advantage of these tips to find the best rates without having to cut coverage. You only need to know the fastest way to find the lowest price online.

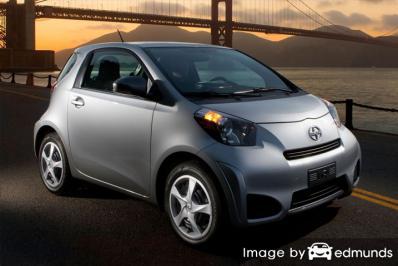

Companies offering Scion iQ insurance in Miami

The following companies have been selected to offer free rate quotes in Miami, FL. If you wish to find cheap auto insurance in Miami, it’s highly recommended you visit as many as you can to get a more complete price comparison.

Discounts can help save money on Scion iQ insurance in Miami

Car insurance can cost a lot, but there’s a good chance there are discounts that you may not know about. A few discounts will automatically apply when you get a quote, but less common discounts must be inquired about prior to receiving the credit.

- Multi-car Discount – Having multiple vehicles with one company may reduce the rate for each vehicle.

- Accident Waiver – Not really a discount, but some insurance companies will allow you to have one accident before your rates go up if you have no claims prior to the accident.

- Auto/Life Discount – If the company offers life insurance, you could get a discounted price on car insurance if you buy some life insurance in addition to your auto policy.

- Professional Memberships – Joining a professional or civic organization could qualify you for a break on your bill.

- Good Students Pay Less – Maintaining excellent grades may save as much as 25% on a Miami car insurance quote. Many companies even apply the discount to college students well after school through age 25.

While discounts sound great, it’s important to understand that some credits don’t apply to the entire policy premium. Most cut the cost of specific coverages such as liability and collision coverage. Despite the fact that it seems like you can get free auto insurance, nobody gets a free ride.

A few popular companies and their offered discounts are included below.

- Mercury Insurance may offer discounts for good driver, anti-theft, location of vehicle, accident-free, low natural disaster claims, professional/association, and good student.

- Farmers Insurance discounts include multi-car, bundle discounts, good student, business and professional, early shopping, and homeowner.

- Farm Bureau offers premium reductions for youthful driver, renewal discount, multi-vehicle, good student, driver training, 55 and retired, and safe driver.

- State Farm policyholders can earn discounts including multiple autos, Steer Clear safe driver discount, defensive driving training, safe vehicle, and passive restraint.

- Allstate may have discounts that include eSmart discount, safe driver, auto/life discount, teenSMART discount, and FullPay discount.

- GEICO may include discounts for seat belt use, defensive driver, good student, anti-theft, and membership and employees.

Check with every company how many discounts you can get. Discounts might not be available to policyholders in your area. If you would like to view insurance companies with significant discounts in Miami, click here.

How Car Insurance Companies Determine Scion iQ Insurance Costs

Many factors are part of the equation when pricing auto insurance. Some factors are common sense such as your driving record, although some other factors are more obscure like your vehicle usage or your commute time.

The following are just a few of the factors utilized by car insurance companies to help set your prices.

Do you need those incidental coverages? – Insurance policies have a lot of optional add-on coverages that can waste your money if you don’t pay attention. Coverage for things like rental car reimbursement, accidental death, and membership fees are examples of these. These may sound like a good investment when deciding what coverages you need, but your needs may have changed so remove them from your policy.

Credit rating impacts rates – Having a good credit score can be an important factor in calculating your car insurance rates. People with excellent credit tend to be less risk to insure than drivers who have lower ratings. If your credit score can use some improvement, you could potentially save money when insuring your Scion iQ by improving your rating.

Premiums impacted by your city – Residing in areas with lower population has definite advantages when talking about car insurance. People who live in big cities regularly have traffic congestion and more time behind the wheel. Fewer drivers and short commutes means fewer accidents and also fewer theft and vandalism claims.

Males are more aggressive – Statistics show women tend to be less risk to insure than men. However, this does not mean males are worse at driving than females. Men and women have accidents in similar percentages, but guys tend to have higher claims. Men also tend to get more serious tickets like reckless driving and DUI. Young men ages 16 to 20 have the highest risk to insure and therefore have the most expensive car insurance rates.

Prices may be lower depending on your employer – Did you know your car insurance rates can be affected by your occupation? Careers such as real estate brokers, architects, and stock brokers usually pay the highest average rates due to job stress and lots of time spent at work. On the other hand, careers like professors, engineers and performers pay the least.

Scion iQ insurance loss data – Auto insurance companies include the past claim trends for vehicles to calculate a rate that offsets possible losses. Models that statistically have increased claim numbers or amounts will be charged more to insure.

The table shown below demonstrates the historical insurance loss data for Scion iQ vehicles. For each coverage category, the claim probability for all vehicles, as an average, is considered to be 100. Percentage numbers below 100 indicate better than average losses, while percentages above 100 point to more frequent losses or statistically larger claims.

| Vehicle Make and Model | Collision | Property Damage | Comp | Personal Injury | Medical Payment | Bodily Injury |

|---|---|---|---|---|---|---|

| Scion iQ | 77 | 81 | 75 |

Empty fields indicate not enough data collected

Statistics Source: Insurance Institute for Highway Safety for 2013-2015 Model Years

When should I discuss my situation with an agent?

When it comes to choosing coverage, there really is not a “best” method to buy coverage. Each situation is unique and your car insurance should be unique as well.

For instance, these questions might point out whether your personal situation might need professional guidance.

- Am I covered when driving someone else’s vehicle?

- Is my ex-spouse still covered by my policy?

- Am I covered when driving on a suspended license?

- Are split liability limits better than a combined single limit?

- Which companies are cheaper for teen drivers?

- Are rock-chip repairs free?

- Am I covered when renting a car or should I buy coverage from the car rental agency?

If you can’t answer these questions but a few of them apply then you might want to talk to an insurance agent. To find lower rates from a local agent, fill out this quick form or go to this page to view a list of companies. It is quick, free and may give you better protection.

Can’t I compare rates from local Miami insurance agencies?

A small number of people still like to go talk to an agent. Insurance agents can answer important questions and give you someone to call. A nice benefit of comparing auto insurance online is the fact that drivers can get lower rates and also buy local. Putting coverage with local agencies is especially important in Miami.

To find an agent, once you fill out this quick form, the coverage information is transmitted to participating agents in Miami who want to provide quotes and help you find cheaper coverage. It makes it easy because there is no need to contact any agents since rate quotes are delivered straight to your inbox. If you wish to get a price quote from one company in particular, just visit that company’s website and complete a quote there.

Do you need an independent or exclusive auto insurance agent?

If you want to use a good Miami insurance agent, there are a couple of different types of agents and how they can write your policy. Agents in Miami are classified as either independent or exclusive depending on the company they work for. Both can write auto insurance policies, but it’s good to learn the difference between them since it can impact which type of agent you select.

Independent Auto Insurance Agencies or Brokers

Independent insurance agents can quote rates with many companies so as a result can place your coverage with an assortment of companies and get you the best rates possible. If they find a lower price, your policy is moved internally which requires no work on your part.

When comparing rates, we recommend you get insurance quotes from at a minimum one independent agency to have the best price comparison. Most have the option of insuring with companies that do not advertise much which can save you money.

Featured below is a list of independent insurance agencies in Miami who may provide free auto insurance quotes.

- JM Private Insurance Agency

7274 SW 48th St – Miami, FL 33155 – (305) 908-1832 – View Map - Insurecentro (Insurance Agency)

1701 W Flagler St #220 – Miami, FL 33135 – (305) 302-2236 – View Map - JVS Insurance Agency

9600 SW 8th St #27 – Miami, FL 33174 – (305) 552-5250 – View Map

Exclusive Agents

Agents that elect to be exclusive can usually just insure with one company and some examples include Allstate and State Farm. Exclusive agencies are unable to place coverage with different providers so they have to upsell other benefits. Exclusive insurance agents are highly trained on their products and sales techniques and that enables them to sell even at higher rates. Consumers often buy insurance from these agents mainly due to high brand loyalty rather than low price.

Shown below are Miami exclusive insurance agents that can give you price quotes.

- Allstate Insurance: Ramon Balladares

2455 SW 27th Ave #210 – Miami, FL 33145 – (305) 859-8556 – View Map - GEICO Insurance Agent

8514 SW 8th St – Miami, FL 33144 – (305) 595-2911 – View Map - Allstate Insurance: Pamela Brumer

141 Alton Rd – Miami Beach, FL 33139 – (305) 531-1223 – View Map

Picking an insurance agency needs to be determined by more than just the premium amount. Below are some questions you should ask.

- Can you get a list of referrals?

- Is the agent properly licensed in Florida?

- How experienced are they in personal risk management?

- Does the agency have a good rating with the Better Business Bureau?

- Will the quote change when the policy is issued?

- Are they paid to recommend certain coverages?

- Does the agent have professional designations like CIC, CPCU or AIC?

In Summary

Throughout this article, we presented a lot of tips how to reduce Scion iQ insurance premium rates online in Miami. The key concept to understand is the more rate comparisons you have, the better likelihood of getting the cheapest Scion iQ rate quotes. You may even be surprised to find that the biggest savings come from the smaller companies. Some small companies may cover specific market segments cheaper than the large multi-state companies such as State Farm and Allstate.

As you restructure your insurance plan, make sure you don’t skimp on critical coverages to save a buck or two. There are a lot of situations where drivers have reduced full coverage to discover at claim time that the savings was not a smart move. Your goal is to purchase plenty of coverage at a price you can afford while not skimping on critical coverages.

To learn more, feel free to visit these articles:

- A Tree Fell on Your Car: Now What? (Allstate)

- How Much are Miami Auto Insurance Rates for Immigrants? (FAQ)

- Who Has Cheap Auto Insurance Quotes for a Chevrolet Malibu in Miami? (FAQ)

- What Car Insurance is Cheapest for a Ford Explorer in Miami? (FAQ)

- Who Has Cheap Miami Auto Insurance Quotes After a Speeding Ticket? (FAQ)

- Who Has Cheap Miami Car Insurance Rates for Unemployed Drivers? (FAQ)

- Medical Payments Coverage (Liberty Mutual)

- No-Fault Auto Insurance Statistics (Insurance Information Institute)

- Vehicle Insurance in the U.S. (Wikipedia)

- Understanding Car Crashes Video (iihs.org)